do you pay taxes on inheritance in north carolina

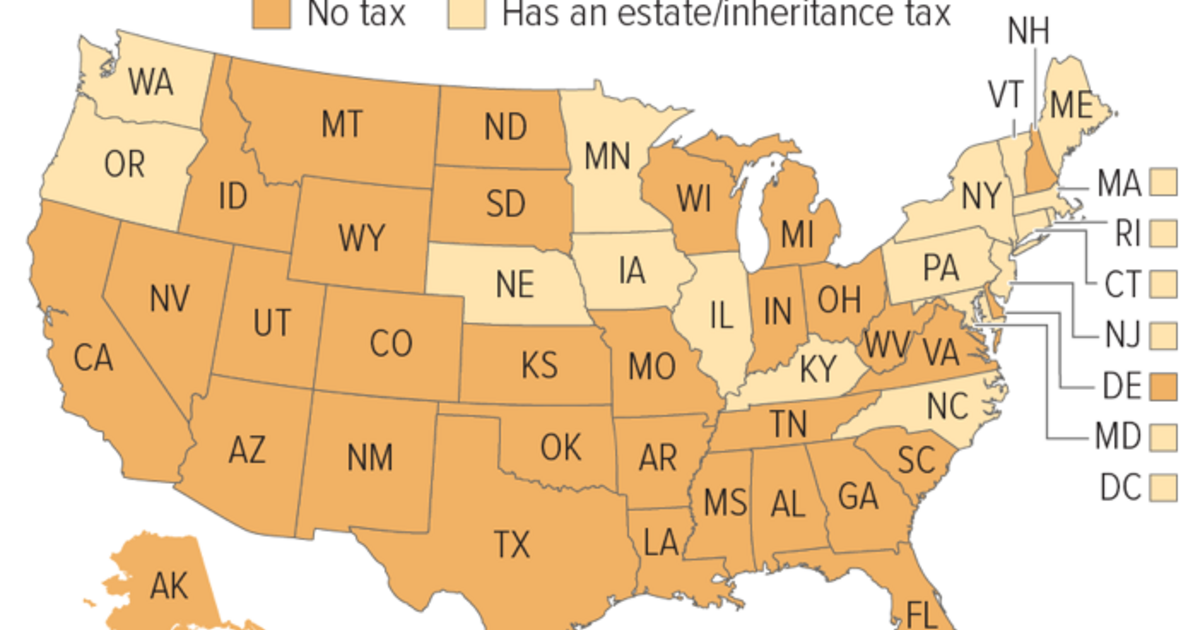

However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate. There is no inheritance tax in North Carolina.

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

Put another way that means that you have a 998 chance of never having to worry about estate taxes.

. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1. With the property tax your federal tax would be 187 million.

However - there is no inheritance taxes on neither federal nor state level in North Carolina. North Carolina does not collect an inheritance tax or an estate tax. An inheritance of 382 million falls into the highest tax rate so youll have to pay 40.

While you probably dont have to pay inheritance or estate tax other taxes may apply. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. Do you pay taxes on inheritance in North Carolina.

Art firearms historic memorabilia and other collectibles may be subject to certain taxes. These include capital gains retirement account income tax and other similar taxes. The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides.

Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015. The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. Only six states have an inheritance tax though Kentucky is one of them.

That is 152 million. In North Carolina there is no such thing as an inheritance tax. Inheritance taxes are levied on heirs after they have received money from the deceased.

Those who inherit money and live in North Carolina may be subject to the inheritance tax of a different state. Estate taxes are imposed on the total value of the estate - if the total estate value is large enough - the executor executor of the estate must file federal and a North Carolina estate tax returns and pay any tax due within 9 months after the death. In other words you can make up to 16000-worth gifts to as many people as you wish every year.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. The estate tax is different from the inheritance tax. The beneficiary who receives the inheritance has to pay the tax.

An inheritance tax is not the same thing as an estate tax. Spouses are exempt from inheritance taxation while children can be exempt or pay a minimal amount. Although there is no federal tax on it inheritance is taxable in 6 states within the US.

North Carolina Inheritance Tax and Gift Tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing. The tax in these states ranges from 0 to 18.

The federal gift tax has an annual exemption of 16000 per recipient. Even if North Carolina got rid of its gift tax you could be responsible for paying gift taxes at the federal level. North Carolina does not collect an inheritance tax or an estate tax.

It has a progressive scale of up to 40. Ad We Specialize in the IRS. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply.

A married couple can gift away up to 32000 to. Do you pay taxes on inheritance in north carolina Saturday June 11 2022 Edit. There is no federal inheritance tax.

It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. That way a joint bank account will automatically pass. However state residents should remember to take into account the federal estate tax if.

Federal estate tax could apply as well. Do you have to pay taxes on inheritance in North Carolina. Call Today for a Free Initial Consultation.

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

Do I Have To Pay Taxes On My Inheritance Greenbush Financial Group

How To Prove Funds Are Inheritance To The Irs

Legal And Trust Issues With Iras Under The New Secure Act 6 Things To Consider

4 Reasons You Should Leave An Inheritance And 4 Reasons It S Ok Not To Gobankingrates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do I Pay Taxes On Inheritance Of Savings Account

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

What Is Inheritance Tax Probate Advance

State Estate And Inheritance Taxes Itep

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

The First 3 Money Moves To Make If You Re About To Get An Inheritance Real Simple

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

State Estate And Inheritance Taxes Itep

401 K Inheritance Tax Rules Estate Planning

Is Your Inheritance Considered Taxable Income H R Block

State Taxes On Inherited Wealth Center On Budget And Policy Priorities